In April 2020, during the first lockdown, many property forecasters were expecting the property market to fall by 5-15% with organisations, such as the Centre for Economics and Business Research (CEBR), estimating falls of 13%.

But, the opposite happened. Property prices started to rise as soon as the market re-opened in May 2020, and this wasn’t expected because if the economy is weak or goes into freefall, property prices tend to follow. However, for the first time, property prices rose, despite the economy’s GDP falling by nearly 10%, one of the biggest declines since the 1700s.

Since this time, property prices have pretty much defied gravity with double digit growth over the last few years.

Property market predictions for 2022

This year though, according to forecasters, prices were expected to go back to a more ‘normal’ growth of 3-5%. The likes of Capital Economics predicted that prices would rise by 5%, while Halifax estimated a lower rise of around 1% - although this was caveated with the statement “forecast uncertainty remains very high.”

What has actually happened to house prices in 2022?

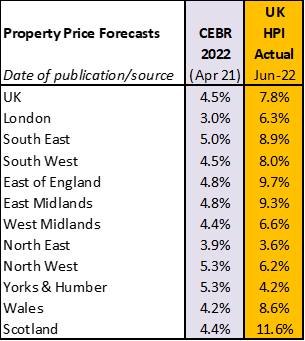

According to the Government’s Land Registry data, property prices in June 2022 had risen by 7.8% across the UK with price growth ranging from 3.6% growth in the North East through to 11.6% in Scotland. As the chart below shows, some were reasonably close, such as the North East, and Yorkshire and Humber was actually less than predicted.

However, predictions and forecasts for 2022 from the likes of the CEBR, were, in the main, a lot lower than actual price rises so far.

Source: https://www.cbreresidential.com/uk/en-GB/research/five-year-forecast-2021

Most property price predictions suggested similar levels of growth to the CEBR in 2022, but as has been the case for the last few years - price rises have managed to surprise even the most expert of forecasters.

What will happen to house prices in 2022 and beyond?

Although price growth is still being reported as being strong, most property experts are finding the market is starting to show signs of cooling. This is because demand is starting to fall versus the levels seen during the pandemic and the number of properties coming to market has started to rise in comparison.

However, it’s important to know this doesn’t mean they are predicting a ‘crash’. Most forecasters are expecting prices to rise in 2022 by around 10%, and due to the higher than expected increases this year, some forecasters are suggesting with the cost of living crisis, this will result in small corrections over the next year or two, such as Capital Economics whose latest predictions suggest that prices might fall by 5% between 2023 and 2024.

Property price growth is very individual to a property

Whatever the forecasters might think will happen, what is essential to know is the forecasts are very generalised. For example, not all property prices have risen by double digits and some have risen far more than 10%.

If you are looking to buy or sell, do speak to a local expert to understand how hot or not the market is.